“5 Smart Strategies for Securing a Small Business Loan in the U.S.”

Title: 5 Smart Strategies for Securing a Small Business Loan in the U.S.

Meta Description (SEO): Learn five proven strategies to boost your approval odds for a U.S. small business loan—covering credit score, business plan, lender choice, collateral, and negotiation tips.

Target Keywords: small business loan USA, business loan approval tips US, best small business loan US 2025, applying for business loan US

Article Body:

Introduction

Obtaining a small business loan in America can unlock growth opportunities—but the process is competitive and rigorous. Follow these five strategies to increase your odds of approval and secure better terms.

1. Strengthen Your Credit & Financial Profile

Lenders pay close attention to your personal and business credit scores. Maintain a strong credit history, keep debt-to-income ratio low, and ensure your financial statements are accurate.

Prepare one- or two-year profit-and-loss projections; be prepared to explain any prior losses and show a pathway to profitability.

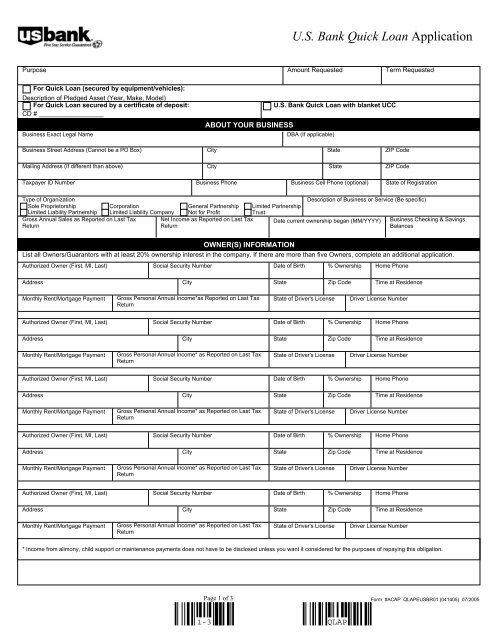

2. Craft a Clear Business Plan & Loan Request

Your business plan should clearly state: what you will use the funds for, how you’ll repay, projected cash flow, and risks.

Specify the loan amount, term, interest rate look-up, and provide collateral if required.

Lenders prefer well-structured requests with clear use of funds (equipment purchase, expansion, inventory).

3. Choose the Right Type of Loan & Lender

In the U.S., options include: SBA loans (backed by the Small Business Administration), term loans, lines of credit, invoice financing, equipment loans.

Match your needs: short-term cash flow boost? Use line of credit. Equipment purchase? Consider equipment financing.

Compare lenders: national banks, community banks, credit unions, alternative online lenders. Terms vary significantly.

4. Prepare Collateral & Personal Guarantees

Many lenders require collateral (real estate, equipment, accounts receivable) and personal guarantees from business owners.

Be realistic: lenders value collateral they can liquidate easily.

If you’re offering your home as collateral, ensure you fully understand risks.

5. Negotiate Terms & Understand Hidden Costs

Don’t accept the first offer blindly. Ask about origination fees, pre-payment penalties, variable vs fixed rate, balloon payment.

Negotiate for better terms: lower rate, longer amortization, fewer covenants.

Keep your documentation ready: business licenses, tax returns, bank statements, ownership records. The easier you make it for the lender, the better your deal.

Conclusion

Securing a small business loan in the U.S. requires preparation, clarity, and smart decision-making. By improving your credit, choosing the correct loan type, preparing strong documentation, and negotiating effectively, you can position your venture for success.