Home Insurance Explained: Protect Your Property from Unexpected Loss in America (2025)

Meta Description:

Learn everything about home insurance in the U.S. — what it covers, how premiums work, and the best ways to save money on your homeowner’s policy in 2025.

Keywords:

home insurance USA, best homeowners insurance 2025, house insurance coverage America, property insurance quotes US, home insurance rates 2025, affordable homeowners policy, fire and theft insurance, home insurance companies USA

Introduction

Your home is more than just walls and a roof — it’s your most valuable investment. A single fire, storm, or burglary can cause financial ruin if you’re not protected.

That’s why home insurance is one of the smartest purchases any American homeowner can make.

In 2025, the home-insurance market is evolving fast. Smart devices, climate-risk modeling, and personalized policies have changed how premiums are calculated.

This guide explains everything you need to know — from coverage types and costs to how to choose the right insurer and save money.

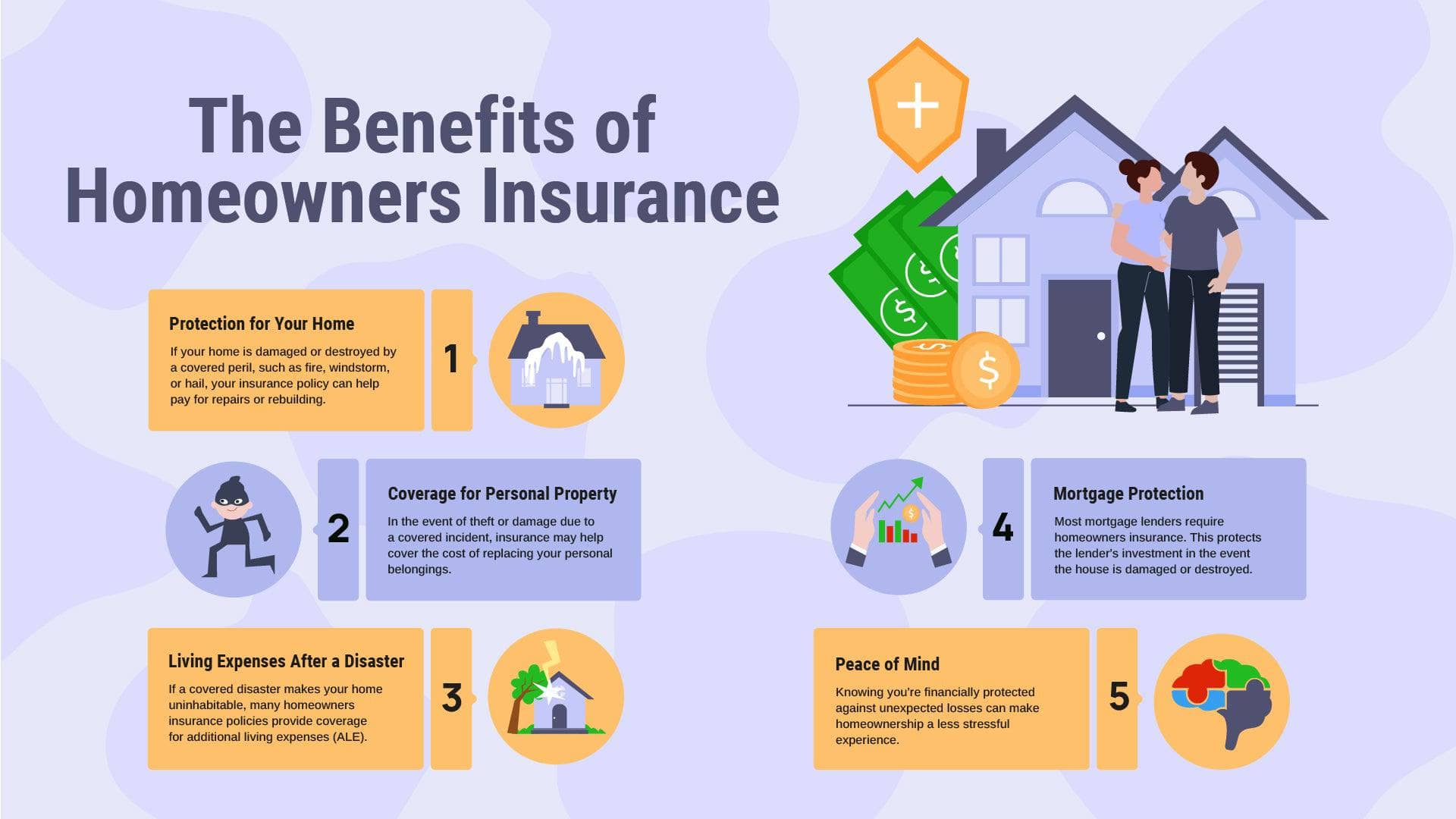

What Is Home Insurance?

Home insurance (also called homeowners insurance) protects you financially if your house or belongings are damaged or destroyed.

It also covers liability — if someone gets injured on your property and sues you.

Most lenders require insurance before approving a mortgage, but even if yours doesn’t, you still need it for peace of mind.

A standard U.S. homeowners policy (called an HO-3) includes four major protections:

-

Dwelling Coverage — Pays to repair or rebuild the structure of your home after covered disasters (fire, hail, wind, lightning).

-

Personal Property Coverage — Protects furniture, electronics, and clothes.

-

Liability Coverage — Covers injuries or property damage you cause to others.

-

Additional Living Expenses (ALE) — Pays for hotel stays or rentals if your home becomes unlivable during repairs.

What Disasters Are Covered?

Most standard policies cover:

✅ Fire and smoke damage

✅ Windstorms, hail, lightning

✅ Theft and vandalism

✅ Water damage from plumbing leaks

✅ Falling objects (like tree branches)

⚠️ Not usually covered:

❌ Floods

❌ Earthquakes

❌ Sewer backups

❌ Neglect or wear and tear

You’ll need separate flood or earthquake insurance if you live in high-risk areas.

How Home Insurance Premiums Are Calculated

| Factor | Description |

|---|---|

| Location | Storm-prone or crime-heavy ZIP codes cost more. |

| Home Value & Rebuild Cost | Larger or older homes → higher premiums. |

| Deductible | Higher deductible = lower premium. |

| Claims History | Frequent claims raise your cost. |

| Credit Score | Strong credit often means discounts. |

| Safety Features | Smoke alarms & security systems cut rates. |

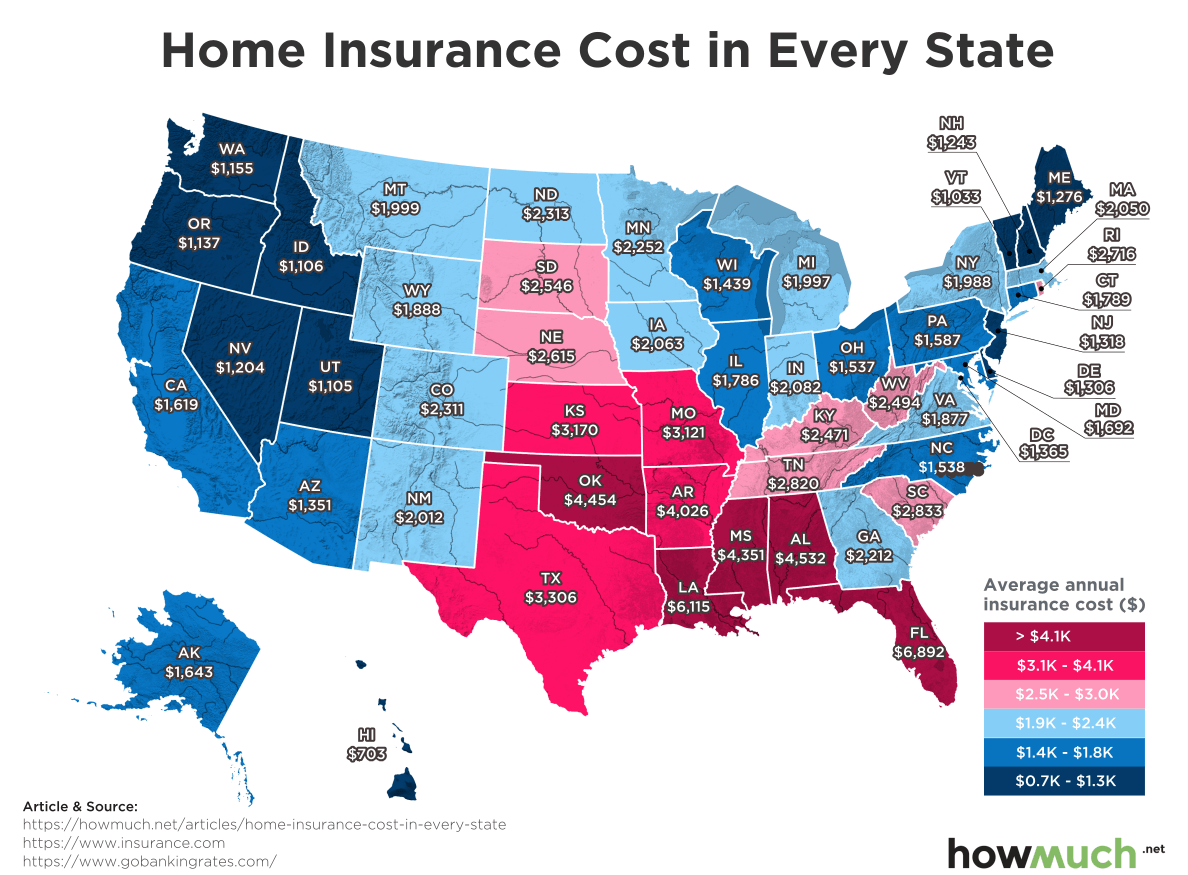

💡 Example:

A homeowner in Texas may pay around $1,900 / year, while someone in Oregon might pay $1,200 — same house, different risk zone.

How Much Coverage Do You Need?

Experts recommend insuring your home for 100 % of its rebuild cost, not its market price.

That means if rebuilding after a total loss would cost $300 000, your dwelling coverage should match that number.

Also estimate the value of your personal belongings — usually 50 – 70 % of dwelling coverage.

Liability coverage should be at least $300 000, but many experts suggest $500 000 – $1 million for better protection.

Common Types of Home Insurance Policies

| Policy Type | Who It’s For | Coverage Level |

|---|---|---|

| HO-1 | Basic form (rare today) | Very limited |

| HO-3 | Standard homeowners | Comprehensive |

| HO-5 | Premium homeowners | Highest, includes open-peril coverage |

| HO-4 | Renters | Personal property only |

| HO-6 | Condo owners | Interior + belongings |

| HO-7 | Mobile homes | Tailored coverage |

| HO-8 | Historic or older homes | Actual-cash-value payout |

If your property has high value or special features (like solar panels), consider HO-5 or an endorsement that adds replacement-cost coverage.

Best Home Insurance Companies in the U.S. (2025)

| Company | Best For | Average Annual Cost |

|---|---|---|

| State Farm | Reliable local agents & nationwide reach | $1 500 |

| Allstate | Great bundle discounts | $1 600 |

| Lemonade | Digital-first, fast claims | $1 200 |

| USAA | Military families | $1 100 |

| Farmers Insurance | Strong disaster coverage options | $1 650 |

Tips to Save Money on Home Insurance

-

Bundle Policies – Combine home + auto + life for up to 25 % savings.

-

Increase Deductible – Moving from $500 → $1 000 saves 10–15 %.

-

Install Security Systems – Smoke, fire, and burglary alarms = lower risk.

-

Upgrade Roofing & Wiring – Reduces fire/storm risk, gets insurer credits.

-

Avoid Small Claims – Frequent minor claims raise future premiums.

-

Shop Annually – Compare at least three quotes every renewal period.

Common Mistakes to Avoid

-

Confusing market value with rebuild cost.

-

Forgetting to list expensive items (jewelry, art).

-

Ignoring exclusions — floods and quakes need separate policies.

-

Not updating coverage after home renovations.

-

Letting coverage lapse — you could lose mortgage protection.

Future of Home Insurance (2025 → 2030)

The next generation of home coverage will rely heavily on technology:

-

Smart-home sensors detect leaks or fires early.

-

AI-driven claims mean same-day settlements.

-

Climate-risk modeling adjusts rates dynamically.

-

Blockchain contracts improve fraud prevention.

These advances make coverage faster, fairer, and more personalized for U.S. homeowners.

Conclusion

Home insurance is your first line of defense against disaster.

It protects not only your house, but your savings, credit, and peace of mind.

By understanding policy types, comparing quotes, and investing in safety features, you can enjoy full protection at an affordable price.

A home is where life happens — make sure it’s secure.