Insurance – “How to Choose the Right Life Insurance Policy in the U.S.”

Title: How to Choose the Right Life Insurance Policy in the U.S.

Meta Description (SEO): Discover how to select the best life insurance policy in America—compare term vs whole, cover amounts, premiums, and riders. High-value advice for U.S. residents seeking lasting protection.

Target Keywords: life insurance policy USA, best life insurance US 2025, term vs whole life insurance, how much life insurance do I need

Article Body:

Introduction

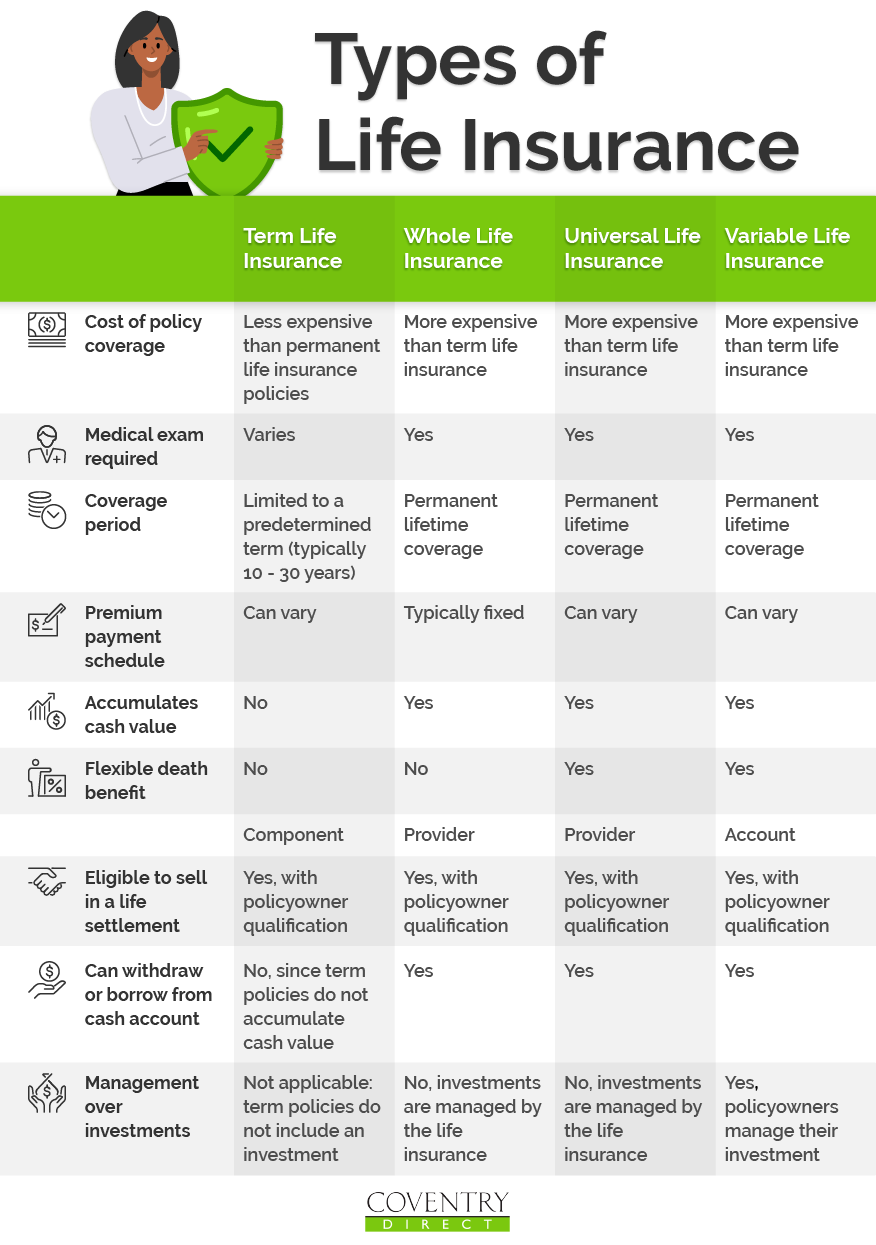

In the United States, selecting the right life insurance policy is one of the most important financial decisions you’ll make. With so many options—term life, whole life, universal life, variable life—how can you ensure you pick the one that truly protects your loved ones? This guide breaks down the key factors you need to understand.

1. Understand Your Coverage Needs

Before you choose a policy, ask yourself: What financial obligations need protecting? Mortgage? Child’s college? Income replacement? A standard rule of thumb is to aim for 10-15 × your annual income as a death benefit. But each household is unique.

Consider your current debts, future goals, and how long you will want the protection to last.

2. Term Life vs Whole Life (and Other Variants)

-

Term Life Insurance: Covers you for a fixed period (10, 20, 30 years). Generally lower premium. Ideal if you’re protecting temporary financial obligations (like a mortgage).

-

Whole Life Insurance: Permanent coverage, builds cash value, higher premium. Good if you have long-term estate planning or wealth-transfer goals.

-

Universal/Variable Life: More flexible premium and death benefit; variable accounts may invest in market. Higher complexity and risk.

Compare premium costs: for example, a healthy 35-year-old often pays far less for a 20-year term policy than a whole life with same face amount.

3. Evaluate Premiums & Riders

Premiums depend on age, health, lifestyle (smoking status), and policy type.

Riders (add-ons) allow customization: e.g., disability waiver, accelerated death benefit (for terminal illness), child term rider. These can raise premium slightly but increase value significantly.

4. Insurer Strength & Policy Details

Check the insurer’s financial strength ratings (from AM Best, Moody’s, S&P). A policy is only as good as the company backing it.

Review policy provisions: guaranteed premium, cash value growth, surrender charges, and policy loans in whole/universal life.

5. When Should You Apply & Lock In a Rate?

Since premiums go up with age and health changes, applying sooner (while you’re healthy) often makes sense.

But ensure you revisit your coverage needs periodically (major life events: marriage, birth, job change).

6. Common Mistakes to Avoid

-

Buying too much coverage without matching budget.

-

Ignoring the fine print (e.g., exclusions, waiting periods).

-

Letting the policy lapse due to non-payment.

-

Not updating beneficiary designations..

![15 Types of Life Insurance Policies: Complete Guide [2025] – I&E | Whole Life & Infinite Banking Strategies](https://www.insuranceandestates.com/wp-content/uploads/types-of-life-insurance.webp)

Conclusion

Life insurance isn’t just a policy—it’s peace of mind. By understanding your needs, comparing policy types, checking insurer strength, and selecting the right riders, you can secure coverage that fits your budget and safeguards your family’s future.